By providing prompt and professional responses, they can enhance customer satisfaction and foster stronger customer relationships. Additionally, outsourcing can help manage overdue accounts through timely follow-ups and payment reminders. It ensures that the company’s revenue cycle runs smoothly, with payments from customers coming in a timely and predictable manner.

- By choosing an expert service provider, you can enter an era of simplified processes and increased profits.

- As your company embarks on its exciting growth journey, remember that streamlining operations is key to sustaining momentum.

- Credit agreements, process automation, automated clearing house (ACH) transfers, AI-driven analytics—there are many options available for your A/R needs.

- However, Outsourcing simplifies financial management, minimizes errors, and boosts efficiency, driving growth and transparency for businesses of all sizes.

- We understand the intricacies of AR management and offer tailored solutions to meet your specific needs, along with complete finance/accounting outsourcing solutions.

- This could impact the quality of your customer relationships and potentially harm your company’s reputation.

- Accounts Receivable is the money customers owe your business for goods or services they’ve received but haven’t paid for yet.

How to Find the Best Accounts Receivable Outsourcing Provider?

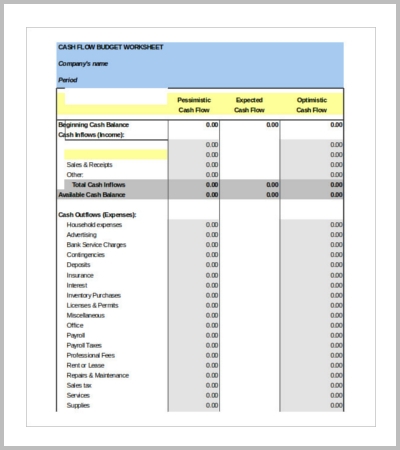

Further, shifting to an outsourced solution typically results in a more predictable cost structure for A/R efforts. After all, you’re usually no longer paying for the required hours, instead dealing with a flat rate for the service. However, whether you’re considering automated A/R software or not, properly understanding the impact that outsourcing can deliver will empower you to make the right choice for your company. Discover how healthcare providers can enhance services with BNPL Food Truck Accounting platforms like Healthcare Finance Direct. Make sure you conduct periodic check-ins with your loyal customers to discuss their experience and make necessary adjustments in your approach to receivables. Plus, any negative action by them can impact your reputation among your customers.

- We’re not only making things faster by utilising new technology and real-time analytics, but we’re also getting a better understanding of our financial situation.

- Checking reputation and reviews is important criteria to consider before outsourcing the AR needs of your firm.

- This can become difficult if you lack the time and resources to monitor AR activities.

- Make sure you go review your AR partner’s process and security protocols while ensuring they have the right compliance technology, firewalls, encryption, and physical security to prevent any data breach.

- Outsourcing can drastically lower these overhead expenses since service providers share their infrastructure and human costs across several clients, allowing for economies of scale.

- Automation can enhance the customer experience by providing quicker, more accurate billing and payment processes.

Can receivables and payables be offset?

With this critical business function now outside of your direct control, your organization is risking a good deal of your ongoing success against the ongoing success of your outsourcing partner. While there’s an initial investment in setting up an automated A/R system, the long-term cost savings can be substantial. You would save on labor costs and reduce the chances of billing errors and delayed payments, thereby improving your cash flow.

Access to expertise:

When you outsource accounts receivable services, ensure that the service providers are flexible and can customize the services per your needs. This will help you in achieving sustained growth that does not diminish over time. Evaluating the experience, why accounts receivable outsourcing is important for a growing firm? qualifications, and expertise of accounts receivable outsourcing services is paramount to ensure you get the desired service provider at your disposal. For this, you can check their LinkedIn profile apart from reviewing their credentials and certifications. Commonly, outsourcing a function will quickly lead to corresponding cost savings. Just as your business is likely very efficient at your core operations, accounts receivable outsourcers will be much more efficient at their core task.

Managing finances and service quality while expanding operations to satisfy demand is one of the largest problems facing expanding companies. A company can flexibly expand its financial operations by outsourcing its accounts receivable. The service provider can swiftly modify resources to manage higher volumes as the business expands, negating the need for the company to make further staffing or resource investments. AR service providers are professionals at following rules and regulations in the financial sector. Learn about the improved cash flow management and reduced administrative burdens that come with professional accounts receivable services.

Struggling to Collect Outstanding Debts?

Outsourcing providers utilize state-of-the-art financial tools and automated systems to handle AR and AP processes efficiently. Businesses benefit from cutting-edge technology without the need to invest in upgrades or maintenance, ensuring they remain competitive in their financial operations. By delegating adjusting entries time-consuming AR and AP tasks, businesses can redirect their resources and energy toward strategic initiatives, such as improving products, expanding markets, or enhancing customer service. Outsourcing frees up internal teams to concentrate on activities that directly contribute to the company’s growth and success. Professional outsourcing providers deliver in-depth reporting and analytics, giving businesses valuable insights into their financial performance.

- The balance sheet lists the total value of accounts receivable as current assets.

- By leveraging an AR outsourcing provider’s expertise, tools, and technology, companies can streamline their processes, reduce errors, and see immediate improvements in their financial performance.

- When outsourcing AR, keep in mind that you are relying on a third party to manage a critical aspect of your business process.

- Professional outsourcing providers deliver in-depth reporting and analytics, giving businesses valuable insights into their financial performance.

- A reputable outsourcing provider can help businesses free up time and resources to focus on core operations while offering flexible solutions that can adapt to the company’s growth.

- Outsourcing also allows businesses to stay ahead of industry trends and leverage cutting-edge technology to enhance their cash flow management.

Both in-house and outsourced accounts receivable teams possess distinct approaches when it comes to managing AR tasks such as invoicing, billing, or reconciliation work. When you outsource your AR needs, you get access to experienced professionals who can handle the complexities of the industry seamlessly. This helps improve the firm’s service offerings, quality as well as operational speed which gives a competitive edge in the complex accounting realm.